Tinned Soup and Tariffs

A dive down the rabbit hole of what it actually takes to make a seemingly simple supermarket product - and what happens when that product gets embroiled in a trade war

Is there anything more American than a tin of Campbell’s Soup?

The condensed soup immortalised by Andy Warhol is still a staple of American supermarkets even today. Indeed, the Campbell’s Company (founded in 1869) is one of the oldest food companies in the US.

So it might seem odd to hear that this quintessentially American product might find itself smack bang in the middle of Donald Trump’s trade war. Yet that’s precisely what’s happening now. Campbell’s warned about tariff impact in a recent analysts’ call, and there have been a few reports on what this spells for American shoppers.

But this is one of those stories that gets more interesting, and more topsy-turvy, the deeper you go down the rabbit hole. Because it turns out that this story is also inextricably linked with the ongoing negotiations over Britain’s trade agreement with America - and, for that matter, the fateful decision last year to close the blast furnaces at Port Talbot.

All of which probably sounds a little… random. Why is the cost of tinned food affected by the fate of an obscure steel plant thousands of miles away in south Wales? Well, you won’t be surprised, given the nature of this Substack, to hear that it all comes back to the Material World.

Let’s start at the start - a long way from the supermarket shelves, where the metal that goes into those tins is being made.

The first thing you need to know is that making a tin can is hard, surprisingly hard. I realise this probably sounds a little counterintuitive. If I asked you what you thought the most challenging steel in the world to make was, you’d probably say: weapon grade steel, or maybe the kind that goes into a submarine hull or into the landing gear on an Airbus A380. But actually in some ways, it turns out making the steel that goes into tin cans (they’re mostly steel - the tin is just a plating) is even more exacting.

For one thing you can’t just use any old metal. The specifications for steel in aircraft landing gear (and submarine hull) are forgiving enough that you can make it with recycled steel made in an electric arc furnace. Back to one of the misconceptions about “virgin steel” - actually we don’t need it for a surprising number of use cases these days.

But packaging steels - the term for the kinds of steels that go into tinned food - are a different matter. You need to roll a very, very low carbon steel out into thin coils of perfect flatness and consistency. You need to plate that steel with tin. You need to treat that tin with a whole series of processes even before it gets anywhere near the plant that takes that steel and turns it into a can.

And of all the grades of packaging steel, the very hardest to pull off is what’s known as “Drawn and Wall Ironed” steel. DWI tins might look a lot like any other tins, but they are considerably more sophisticated, because the body is formed of one piece of metal (unlike old-school can bodies which are actually formed of two pieces of metal soldered together). Essentially you take a steel disk and stretch and form it in a metal press/die, ending up with a can that’s light, uniform and seamless. For a product like tinned soup, it’s the dream can.

The catch is, you can only pull this off if the steel disk you’re inserting into the machine is phenomenally good steel. Any blemishes or areas of weakness in the metal and it’s a bit like blowing up a dodgy balloon - except with metal.

All of which is to say: making this kind of steel is quite hard, and, for the time being at least, those who decide metal grades and processes have determined that only blast furnace iron will do.

Oh, and there are only so many companies around the world making it. There’s plants in the Netherlands, in Germany and Korea. There are some makers of DWI quality steel in China, where the quality was historically below par, but is improving all the time. And for decades, packaged steel has been one of the proudest products of the steel mills of South Wales, owned these days by Tata Steel.

Tata recently shut down the blast furnaces at Port Talbot, with an audacious (and controversial) plan. The superficially audacious part you probably already know about: they would replace all their steelmaking with an electric, and much lower carbon, alternative. There are all sorts of reasons this will be hard - not least the fact that Britain has the highest electricity prices in the developed world. But actually that’s not the really daring bit. The really daring bit is that they also want to become the world’s first scale producer of electric arc furnace-made DWI steel.

No-one has managed to make recycled steel at scale that’s consistent and reliable enough that if you stretch it out like a balloon it maintains its integrity. Tata think they have a chance to crack this nut. But the more you understand about the nature of this kind of steelmaking, the more you realise that what’s happening in Port Talbot is even more of a gamble than is widely appreciated.

Anyway, the other important thing to note is that America, most of whose steel is made these days not in blast furnaces but electric arc furnaces, doesn’t make anything like enough DWI steel to satisfy its demand for cans. And since no-one is building new blast furnaces, it’s not likely to any time soon. So, for the foreseeable future it will have to import it in from overseas.

About 80 per cent of American tin cans are made from imported steel. And since that steel can’t easily be substituted, the companies that make those cans will have little choice but to pay the tariffs imposed by Donald Trump.

None of this ought to have come as a surprise to the White House. Last time they imposed tariffs on metals in 2018, they eventually excluded certain products, like these, that couldn’t really be substituted or reasonably quickly replicated domestically. This time: no exceptions. Steel importers face 50 per cent tariffs on everything. So if things continue as they are right now, it’s pretty inevitable those costs will eventually spill into the US economy, potentially being passed onto consumers in the form of more expensive condensed soup (and other tinned items).

But this brings us to the much-hyped trade agreement with the UK. As you’ll no doubt be aware, President Trump has announced a deal with Britain, which will permit it tariff-free access for steel and aluminium, as well as for a certain number of cars and aerospace products. That would be a big deal for American tinned food producers, because right now a significant chunk of their DWI steel comes from… Tata Steel in Port Talbot.

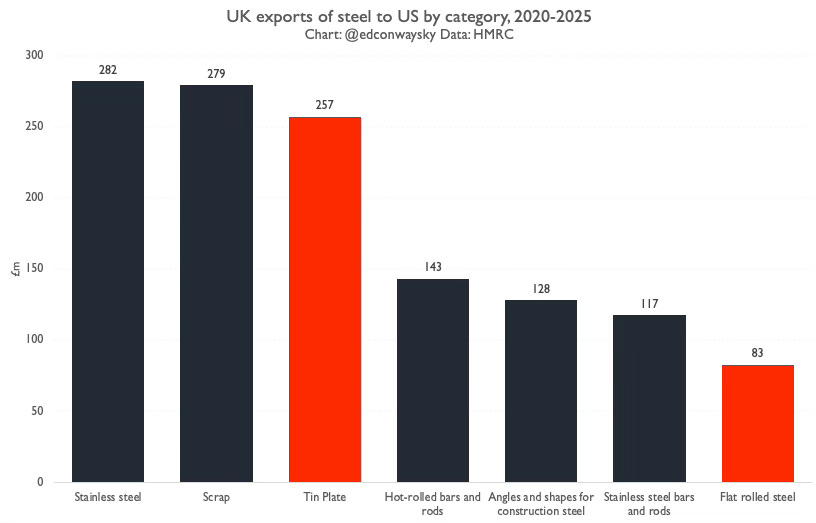

Indeed, look at the UK’s steel exports to the US by category and you can see packaging steel, or “tin plate” as it’s also confusingly known, is the third biggest category. I’ve marked the types of steels that come from Port Talbot in red here. For all that Britain might not make much steel these days, it’s actually quite important when it comes to tin cans.

Sidenote: this is a reflection of the way the global steel market works these days. Rather than trying to make every kind of steel, many countries now tend to specialise in certain varieties of steel, with the presumption that, since it’s a global market, they can just buy in the other stuff from elsewhere. So Britain is a moderately big player in tin cans and coil, but it doesn’t make any weapons-grade steel (that’s Sweden) or plate steel (mostly Asia).

Anyway, back to that trade “deal”. In theory, it could ensure at least some tariff-free DWI steel gets into the US. Welsh mills could help save American tinned food buyers a good few cents! But, despite being proudly announced by Trump and Keir Starmer many weeks ago, only the car and aerospace part of the UK-US agreement has actually been formalised. The metals deal is seemingly missing in action.

Why? It comes back, in part, to those blast furnaces in Port Talbot. Because Tata has shut down the furnaces and has yet to build the electric arc furnace that will (in theory) replace them, it is temporarily having to ship in most of its virgin steel from the Netherlands and India. That steel then gets processed in its existing plants and turned into the DWI its customers have come to expect.

The upshot is that the DWI steel being made in South Wales was actually “melted and poured” (a key bit of terminology in steel) somewhere else altogether. Strictly speaking, it’s not really UK steel at all. It’s just processed here.

That might seem like a moot point, but for the American trade negotiators it’s all-important. They have insisted in talks with their British counterparts that only steel “melted and poured” in Britain should be entitled to be tariff-free. And if that stays the case, even Tata’s DWI steel will face the same tariffs as everyone else.

So here we are. A mazy, unpredictable set of circumstances, all of which mean American consumers end up facing higher Campbell’s Soup prices. But this is just one tiny example of what happens when tariffs get imposed. I wrote a bit more about this in relation to aluminium (sorry, aluminum) for the Washington Post the other day. Even if you have 100% faith that tariffs will bring back production to the US, it will take many years to happen (beyond the life of this presidency) and it also forces you into perverse decisions. Should America be using more of its power generation to smelt aluminum or to run data centres or chip foundries? The logic of tariffs is to incentivise aluminium smelting over those other sectors.

In the meantime, for UK steelmakers (and, by extension, American tin-makers) the clock is ticking. The President has insisted that if the UK’s steel deal isn’t agreed by 9 July then it could be scrapped altogether.

Doubtless there are countless other such rabbit holes out there - do message in or comment if you’ve encountered one yourself. I suppose what we’re living through is a surreal collision between trade theory and chaos theory.

Attending the Assoc for Heterodox Economics Conference at KCL, one excellent speaker, Sean Starrs, described the U.S. power of Techno-Nationalism that allows the U.S. to have a choke-hold over the delivery of Dutch chips to China. (You have written eloquently about ASML in Material World) who are thus prevented from supplying China (as I understand it). While this maybe true - coming back to raw materials and metal - a choke-hold only works in wrestling up to the point the opponent fights according to the rules. The below-the-belt move China has is that they can indeed wield great power via their Rare Earth supply without which certain parts in the F35 (as a tiny example) cannot be made, endangering production of the entire aircraft. Mr Trump believes the U.S. can make its own Rare Earth (Lanthanide) elements because they are abundant in nature. But exactly like the specificity of the steel issue you have outlined above, there is a shortage of process (not a shortage of metal). If only China presently separates Terbium and Dysprosium within the lanthanide group - both intrinsic to make the permanent magnets required by the F35 - then the other rather sophisticated hi-tech is likely to remain on the runway. I have never been a great fan of globalisation but without free trade the issues you have pointed out will multiply. Yes, we all know Rare Earths might be under the ground in our back gardens - but try making a factory to separate each of the 15 elements as you leach them with Hydrochloric Acid and pour the waste into the Thames (as China pours it into the Yellow River) - it’s highly polluting and in China the environment pays the price. If the U.S. (and others have made this point) wants to onshore all Rare Earth production, doing it right would make a kilo of terbium, dysprosium, neodymium etc many hundred per kg more expensive thus making the F35 Campbell’s Soup Can of the sky unsustainable and impossible to build.

Yes, tariffs are a generational project. I doubt that any democracy has the persistence of vision to see them through for the thirty years required.