Beyond Gigafactories

They are the exciting new industrial story everyone wants to talk about. But it turns out they're only one small step in the giant leap towards a battery ecosystem. Part two of an ongoing series...

If you’ve read the first instalment of this guide to batteries you’ll already know a bit about what’s going on inside them.

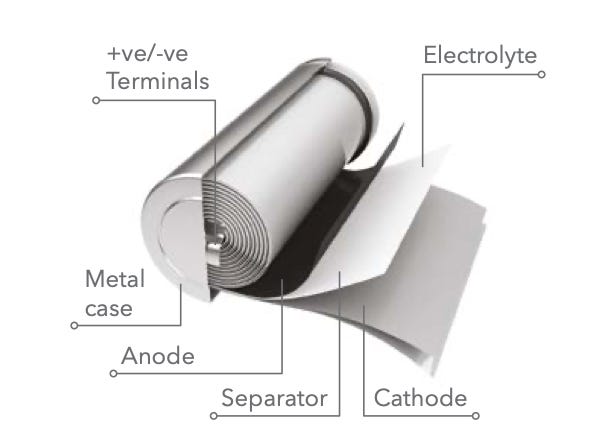

You’ll know that what looks from the outside like a simple canister or box is actually a complex of tightly-packed layers of foils and chemicals, interspersed with thin sheets of polymer separator and bathed in a special electrolyte solution. And you’ll know that the critical function in this cell is to allow lithium atoms to shuffle across from one electrode - the cathode - to the other, the anode.

You might also be wondering: so what? Interesting as that all is, what practical relevance does it have in the real world? As it turns out: rather a lot. For now that you understand the internal architecture of a battery there are quite a few economic and political lessons to tease out.

Perhaps the first and most important concerns one of the vogue terms in the world of geopolitics these days: gigafactories. A gigafactory is a term made up by Elon Musk to refer to a big battery factory. Every leading industrialised country now wants a gigafactory or three.

Why? Because nearly every leading industrialised nation also has a pretty sizeable car industry and those car industries are in the process of being completely disrupted. It comes back to the fact that switching from internal combustion engine to electric vehicles also upends much of the economic model for motor manufacture.

The Moat

Right now, most of the value in a typical car made in Germany, France or the UK comes from the engine (and all its thousands of highly-engineered parts), the gearbox and transmission and then the other bits and pieces that sit around them. When you pay for an internal combustion engine (ICE) car, this stuff is most of what you’re paying for. And at present, most of this stuff is made domestically or in Europe. Here in the UK, for instance, we’re actually pretty good at making car engines (Britain actually exports considerably more engines than we import).

And since making engines is hard (think of all the moving parts and how well you have to make these things to ensure they’re reliable) and expensive, there are a couple of consequences. One is that car manufacture still has lots of high paying, high skilled jobs. Much of the country’s manufacturing heartlands have been hollowed out, but the firms that make cars and, even more importantly, the thousands of firms which make the components that go into cars, have actually done pretty well in recent decades.

The other consequence was that car manufacture became a sort of economic moat around the American and European economies. China might have managed to dominate much of the world’s consumer manufacturing but, even up until a few years ago, it had struggled to get as much market share in the car business. In part, that was because making cars is just hard, and takes a fair bit of work. In part it was because Europe and others protected their industries with complex trade rules that encouraged domestic producers to keep making things locally.

For instance, most of the trade deals Europe has done with other areas or regions stipulate that cars can be exported tariff free, but only if a certain percentage of the value of the car is made in Europe - around 55 per cent in the case of a relatively recent deal with South Korea. Much more on the sums here in this excellent piece from Sam Lowe.

Those kinds of hurdles are pretty trivial with ICE cars, where most of the value is indeed made domestically. But the shift to battery vehicles changes things completely.

Giga

The reason comes back to the fact that the majority of value in a car is not to be found in the motor (far fewer moving parts, far less opportunity for clever engineering) or the transmission or indeed any of the other bits European and American manufacturers typically excel in, but the battery.

Estimates vary, but around 30–50 per cent of an electric car’s value is to be found in the battery. You probably already see the issue. If Britain (and for that matter Europe) is going to be able to clear those hurdles (55 per cent domestic content) and therefore export tariff free, then it really needs to be making the batteries domestically.

Of course these rules of origin are really just that: rules. But they also stand for a broader quandary. Since most of the value in an electric car is in the battery, not the engines, the core of Europe’s high-skilled automotive sector is about to be hollowed out. The stuff we’re good at is no longer especially important.

Now, we shouldn’t get too carried away here. There are many parts of motor manufacture which remain important even in the electric car age, from the design of motors and chassis to the engineering of drive components and interiors. There’s no reason the UK and Europe couldn’t remain leaders in that stuff. But there’s really no escaping the enormous gravitational shift occurring here: the highest value stuff we do is about to evaporate.

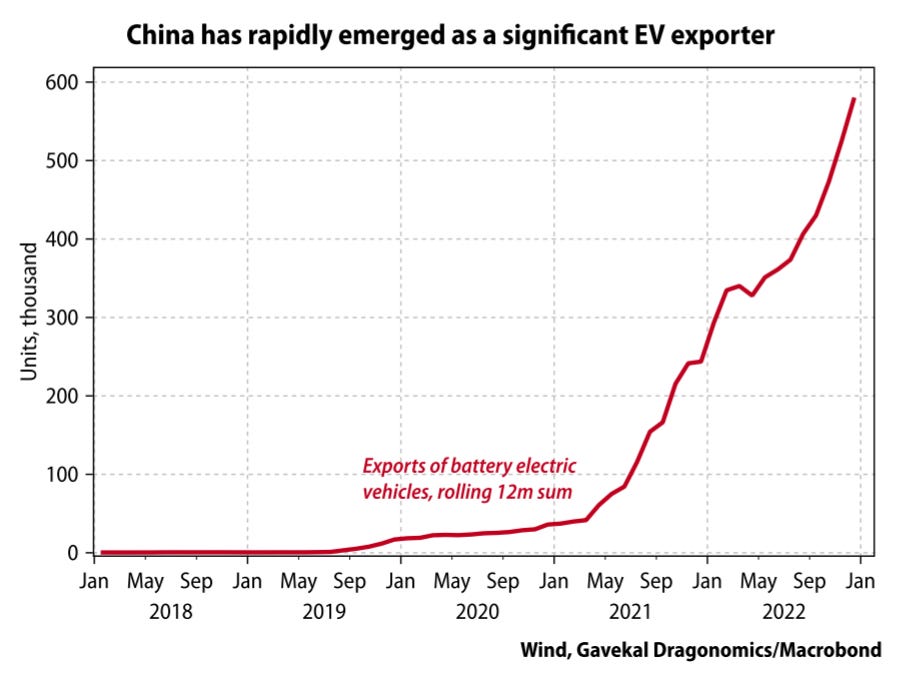

Indeed, it’s already happening. Because Asia (and especially China) has such a commanding lead on making batteries and since the most important part of making an electric car is making the battery, the moat around Europe and America’s car industries is being vaulted by China. If you’ve bought a Tesla Model 3 in the UK then the chances are it came from China (and the chances are the cathode chemistry in the batteries is lithium iron phosphate - that cocktail we covered in the last article which doesn’t use any cobalt). China might have lost the battle to make internal combustion engine cars but it has a massive head start in the race to make battery cars. Just look at the implications for trade.

This has not of course escaped the notice of Europe’s car industry which is deeply aware that if you want to keep enough high value automative jobs you really need a fully-fledged battery industry. Now in theory Europe could just import these batteries from elsewhere. China’s cost advantage these days is such that it easily outweighs the 10 per cent tariffs we have to pay to get cars from there (hence why it’s car exports are going through the roof).

But no one especially wants to be wholly reliant on China for this critical technology. Moreover, since batteries are bulky and quite volatile (remember lithium is explosive) typically motor manufacturers prefer to source them locally. They prefer doing that anyway, since their economic model revolves around just in time delivery.

Put this all together and you can see why nations all around the industrialised worlds are competing for gigafactories. It’s not just about having a sexy new sector: it’s existential for their car industries. So countries, the UK included, seem to be quite happy to throw money at companies if they pledge to build their factories locally.

Breaking it down

Except that… building a gigafactory is only the start of it. Because you know from my previous article that actually batteries are really just assemblages of other valuable components like cathodes and that much of the value in things like cathodes really derives from the expensive chemicals contained in them, you can see that one needs to go far further than just having a gigafactory.

This chart (from an excellent Warwick Uni presentation) tells the story pretty well. Look: more than half of the value inside a battery is in the materials on the cathode.

All that’s happening at the gigafactory is that the cathode materials are being pasted onto foil and then rolled up alongside the anode and separator and put into a battery. Much more on how this all works in Material World, by the way. I don’t want to overstate it: a chunk of the value in an electric car is indeed generated at the gigafactory, since it takes a certain amount of work and expertise to do this. But, and this can’t be overstated enough, there is no way Europe and the UK will generate enough of the added value in its cars to fulfil its own trade rules on car exports without also making the chemicals and materials that go inside them.

So let’s take a future electric Range Rover. Even if the battery is going to be made in the UK, the chances are it won’t pass the hurdle. For it to qualify for all those free trade rules, we could do two things. We could endeavour to make the cathode active materials that get pasted onto the electrodes too. We could endeavour to mine some of the lithium that goes into those chemical mixes. The problem is, right now the vast, vast majority of the world’s cathode active materials are made in Asia and shipped to gigafactories around the world.

The alternative route is to carry on buying in all the cathode active materials from Asia and instead to try to make all the “other” stuff that goes into the battery. We could make the graphite that goes onto the anode. The UK currently makes a lot of the carbon that eventually gets turned into battery graphite, but we ship it off to China to be processed. Below is a film I made about precisely that.

It’s not entirely implausible to try to build a graphitisation sector in this country. But this is precisely the kind of dirty, carbon-intensive industry the UK government has typically preferred to send offshore. And even if we made the entire anode in this country it still wouldn’t be enough: we’d also need to make the rest of the battery components too: the separator and the electrolyte. Again, this is not implausible. The problem is, while there’s a growing awareness among politicians that we need to make batteries, there’s less recognition or awareness that far that we also need to be making battery components.

But we do. These gigafactories, exciting as they are, are only a kind of assembly point for a load of other materials we haven’t even begun to start making ourselves. This is a really big deal! And it’s why you should ask yourself, amid the flurry of news due in the coming months about new battery plants here, there and everywhere: “OK, fine, but what about the other stuff? What about the cathode plants? What, for that matter about where we source the lithium from? What about the graphite? Can we use our petrochemical industries to make separators, or our chemicals sector to make electrolytes?”

Because the reality of the energy transition is far, far deeper than you might have thought from what you tend to hear from politicians or, dare I say it, much of the media. It’s a lesson that’s been drummed into me during the past few years as I researched Material World. And the fascinating thing is that batteries are only one tiny part of a far bigger story, one I do my best to begin charting in the book.

Another great piece - thanks. Do you know what happened to cause US imports of EVs to the EU-27 to disappear from Sept 2021 onwards (as per the Eurostat graphic)?

Thank you for highlighting the political aspects of the energy transition - the within-country politics and the way that they lead to international politics. That's something I hadn't thought about much at all.

Once you start thinking in political terms, there's one other thing that will be exercising a quite few brains in the years and decades to come: what would an electrified defence force look like? Is it even possible? On the face of it, a battery-powered main battle tank is an absurd idea--so are tanks going to be obsolete, or do countries keep bijou fossil fuel and internal combustion engine industries for their defence needs?

A century or more of military doctrine is going to have to be re-thought from first principles.