The Race to Win the Industrial Revolution

A tiny company near the clifftops at the most northerly point in mainland Britain might be about to play a small but important role in the biggest economic story of the coming decade

Thurso, the northernmost town in mainland Britain, is hardly the first place you’d expect anyone to situate a pioneering technology company. Yet here, a few miles down the coast from John O’Groats, within sight of the Old man of Hoy over in Orkney, you’ll find a small but significant firm called AMTE.

You probably haven’t heard of AMTE before, or for that matter the name it used to go by up until a few years ago: AGM. But this is a little company with a very interesting history and, quite possibly, a very interesting future. Its past and its present tell you rather a lot about the underbelly of our economy, not to mention the global race to produce green technology.

They also illustrate a kind of subplot to one of the big global economic stories of the moment. As the world’s superpowers put untold resources into trying to win the race to create the green technologies that might help resolve climate change, many other countries around the world are wrestling with what on earth they should be doing. With the US providing hundreds of millions of dollars of subsidies, is there anything smaller nations like the UK can do? Come to mention it, what happens to nations which take a different view: that far from subsidising their industries, they should be allowing them to sink or swim unassisted?

In short, what happens in the UK is suddenly quite relevant.

A Little Factory with a Big History

Anyway, back to AMTE, who I first encountered while researching Material World. The company didn’t quite make the grade for the book, not so much because its story wasn’t interesting - as you’ll see below, it certainly is - but because the primary focus of the book is not on clever, niche technologies but on the mainstream manufactured products that have changed all of our lives. AMTE has for most of its existence (and that of its precursor companies) focused on small corners of the battery market. However, this little factory in the furthest corner of this country stayed in my mind, because of what it says about this country and its industrial destiny.

AMTE’s story begins back in the 1980s, when a group of chemists hundreds of miles south at Oxford University invented the critical components for something which has since become incredibly important: the lithium ion battery.

These days lithium-ion batteries are everywhere, in smartphones, laptops, little disposable vapes and, of course, electric vehicles. And these days they are, a little like the semiconductors that go into smartphones, computers and pretty much all electronic devices, one of those products with geopolitical resonance. It isn’t just that our ability to eliminate carbon emissions and fulfil climate goals depends in part on our ability to produce enough of these cells. It’s bigger than that, for around 80 per cent of battery production happens in China, and even the staggering amount of money Western governments are throwing at the sector will barely reduce this proportion in the coming couple of decades.

But back in the 1980s none of this was especially obvious. As I cover in some detail in The Book, the pursuit of lithium as the ultimate battery metal actually began nearly a century earlier. But only in the 1970s and then the ‘80s did it begin to become a reality (taming lithium, an incredibly volatile element, was very hard).

First, Stan Whittingham made a tiny lithium cell and came up with some of the chemical theory we still rely upon in batterymaking today, then those Oxford chemists led by American John B Goodenough came up with the optimal cathode chemistry - the lithium cobalt oxide mix we still use derivations of in our smartphones today. That wasn’t the last great leap: in Japan, Akira Yoshino had some big breakthroughs on how to structure the anode, using a form of graphite which is still partly cooked up in oil refineries today and nailing down the best kind of separator that sits between anode and cathode.

And the breakthroughs and refinements kept coming in the years that followed: new forms of battery chemistry, new form factors, better performance and so on, all the way through to today. Still, probably the biggest leap was the one in Oxford in the 1980s, hence why this moment is commemorated with a blue plaque at the labs there today.

The conventional story of lithium ion cells is that the first commercial ones were developed by Sony in the early 1990s. They went into some of the Japanese company’s video cameras and in due course were incorporated into other consumer products until they came of age in the early 2000s with the advent of the smartphone. Despite the fact that the cathode technology in the batteries was developed in large part in the UK, the actual product was turned into a reality on the other side of the world in Asia. And Asia has dominated battery manufacture ever since.

However this is to ignore this obscure plant in Scotland. For back in the early 1990s it was also making some of the world’s earliest lithium ion batteries. It was there with Sony at the vanguard.

Indeed, in some senses the batteries they made in Thurso were considerably more advanced than the ones made by Sony. This was the first company in the world to mass produce a big, chunky cylindrical D-cell lithium ion battery. This was no mean feat: for various reasons, making bigger lithium ion batteries is a considerable technical challenge. And the batteries made in Thurso by the company, known at the time as AGM, were bigger than the comparatively thin ones made by Sony.

In other words that conventional story - that clever academics in the UK (and for that matter the US) came up with a clever innovation and then allowed other countries to take those patents and turn them into a commercial product - isn’t quite the full story! Some of the world’s very first lithium ion batteries were made and sold here in the UK in this forgotten factory in the furthest reaches of the country.

But here’s the critical thing. While Sony was making and selling batteries to consumers in its handycams and its Discmans, AGM was making and selling batteries to a far smaller market: the military. Those D cells went not into consumer electronics but into radios used by the army and into nuclear submarines. This was a lucrative, reliable, comfortable market. It was a market the UK, with its big arms sector was actually rather good at.

And, for that matter, it was a market the regulatory authorities in the UK like the Atomic Energy Establishment were actually familiar with. That mattered because, for abstruse reasons, the UKAEA, as it’s now known, owned the patents to Goodenough’s invention. That meant, by the way, that the UK state actually made a killing from the invention, since Sony had to pay the UKAEA for its use of the patents over the coming years. It also helps explain why AGM was set up in this small town on the north coast: Thurso was right next door to Dounreay, the site of an important breeder reactor and the Vulcan Naval Reactor Test Establishment, where military submarines were tested. In the mind of the industrial strategists of the early 1990s, Thurso seemed like a promising place to create a broader energy hub.

But in the event, AGM did little beyond making small but excellent batteries for a very small military customer base. Meanwhile, Sony and its Japanese (and then Korean and Chinese counterparts) made the batteries that went into billions of electronic devices. The UK went niche; Asia went big.

Roll on a few decades, and AGM has now become AMTE Power, following a management buyout and various boardroom shenanigans. Those military contracts have gone but the machinery is still in the same factory in Thurso, overlooking Orkney and the Old Man of Hoy.

This is still the longest-running battery factory in the UK, and the only UK-born battery company we have left. But the main focus in the world of batteries this days is on scale - on gigafactories which churn out billions of watts worth of cells each year. And by contrast AMTE is still very small indeed.

They have some interesting plans. They want to make a super high performance lithium ion battery which could be used in hydrogen fuel cell cars (fuel cell cars also need batteries as well as the fuel cell, to help conserve power through regenerative braking). They are beginning to turn out sodium ion batteries which are perfectly suited for energy storage (and since their chemistry is based on sodium you can theoretically make much of the cathodes from salt - another material in The Book).

They also have an intriguing “ultra prime cell” which isn’t actually a rechargeable battery. Instead, it’s a lithium ion battery which has a far, far longer life than any other comparable cell. It can withstand extreme temperatures, and discharges very little of its energy when not in use. While the best other competitors will last maybe six months, this one can last many years. For companies wanting to power sensors in remote equipment buried under the ground (eg consider someone operating an offshore oil rig or another remote platform), this new cell could be a really big deal.

However, as you’ll probably have sensed, none of these applications are exactly mainstream. This factory, which began its life as a niche producer, is hoping to stake out a future as a niche producer. Except that there’s a chance they may not be doing all if any of that production in the UK. When I went to visit them for a Sky News film I made the other week, they said it made far more commercial sense for them to consider shifting at least some of their production to the US.

The Inflation Reduction Act

The reason comes back to the US Inflation Reduction Act, which is both the most important piece of legislation in recent economic history and also the worst-named piece of legislation in modern history. It’s badly named for a few reasons. First and most obviously for a British Isles audience, devising any act whose initials are IRA is incredibly indelicate (coming from America’s most Irish president it’s doubly indelicate!).

Second, it will do nothing whatsoever to reduce inflation; on the contrary, given it’s designed to boost economic activity then all else equal you’d probably expect it to lift inflation rather than reducing it.

Third, and most importantly, the name says nothing about the significance of the act. The IRA is a very big deal indeed. If you believe that we’re currently living through a new Industrial Revolution (as you may know I think there’s quite a strong argument) then the point of the IRA is to try to ensure as much of that revolution happens in the US rather than elsewhere. It is chock-full of subsidies - tax credits mostly - which give manufacturers an incentive to locate production in the US.

The scale of the act is hard both to get your head round and to quantify reliably. The number most often bandied around is $300–400 billion, but this is just an estimate. Since the cost of the act will depend on how big takeup is, it could be far smaller or far, far bigger. On the basis of noises coming out of the US, the latter seems far more likely. Some think it could end up amounting to more than a trillion dollars of subsidies.

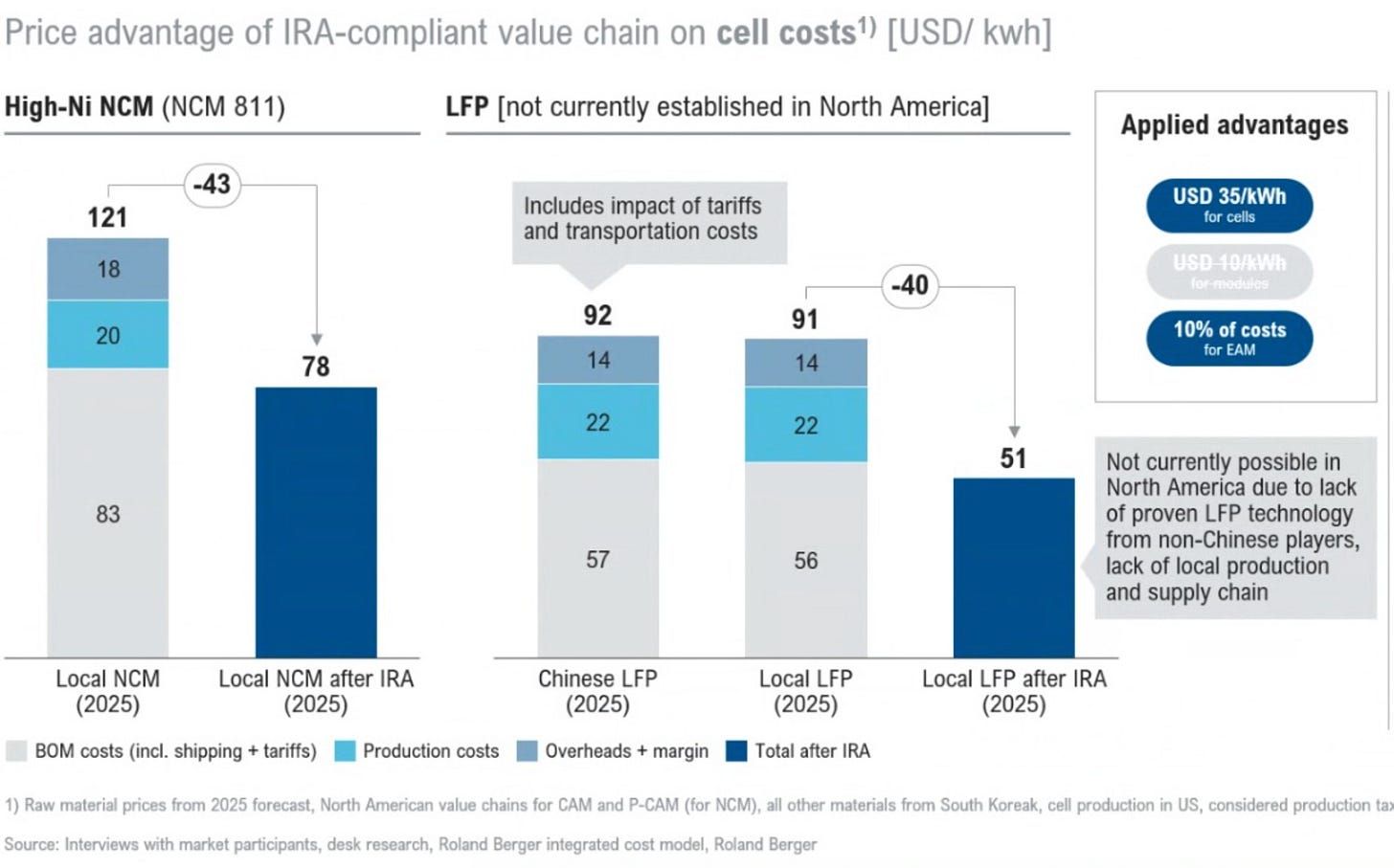

The IRA is a big deal for all sorts of other reasons too. It’s the first time the US is engaging sincerely in serious industrial strategy since the 1970s. It’s also incredibly provocative for overseas producers. You get a sense of this by considering the following chart, produced by Roland Berger, showing the cost of making a battery in the US before and after the impact of IRA.

Look, in particular, at the chart on the right. This is showing you the cost of producing a lithium ferrophosphate battery (LFP). These are the slightly lower range lithium ion batteries in which Chinese manufacturers have an enormous lead at present (they also don’t need cobalt, so they’re becoming more and more attractive these days). All of a sudden, following the IRA it becomes cheaper to make these cells in the US than in China.

It’s hard to express just how a big a deal this is. Now picture charts like the above across the entire energy sphere: similar charts for solar panel manufacturing, for carbon capture, for wind turbines and hydrogen.

The striking thing when you read through the accompanying documentation is just how broad and big the IRA subsidies are. And the upshot is that if you’re a company contemplating where to build your next battery factory (or hydrogen plant or solar or pretty much anything else) then all of a sudden the US becomes considerably more attractive.

So it’s no surprise that AMTE, along with many other UK companies, are talking out loud about moving production to the US. Now, on the one hand, you’d of course expect UK producers to make a song and dance about this. They want their own subsidies! Of course they do! And there’s big risks in doling out subsidies. What, for instance, if this turned out to be another BritishVolt?

On the flip side, it’s very plausible that a lot of green technology firms could relocate from the UK and Europe to the US in the coming years. That said, the EU is already embarking on its own rival plan to the IRA. Indeed, viewed through some prisms, the EU is already forking out considerably more than the US on green subsidies.

So… What does the UK do? For decades, ever since the failures in industrial strategy in the 1970s, Whitehall’s institutional instincts have tended towards non-intervention. But in a world where every superpower is engaging in expensive and distortionary industrial strategy, does that attitude still work? The impression I get, from having spoken to many people inside and outside government about this in recent months, is that right now the UK is still quite a long way from formulating a response.

Jeremy Hunt says he’ll have more for us on this in the autumn statement. His problem is that companies are taking these decisions, about where to locate their factories and where to expand now. But he has hinted, both in his recent Times article and indeed his interview with me in Washington the other week, that he is inclined against US-style subsidies. As he put it in The Times:

Our approach will be different — and better. We are not going toe-to-toe with our friends and allies in some distortive global subsidy race.

With the threat of protectionism creeping its way back into the world economy, the long-term solution is not subsidy but security.

Yes, we will continue to back industries of the future, however, we will target public funding in a strategic way in the areas where the UK has a clear competitive advantage.

Which is all very well, but what does that mean in practice? In theory you could look at AMTE and say it’s a company which does have some strategic strengths. It’s not a big battery maker trying to go toe-to-toe with CATL (the world’s biggest cell producer). It’s focusing on small niches where it might be able to stake out a presence. It has an advantage in some of these niches. So it seems to tick some of the boxes laid out by Mr Hunt. Yet it has also looked at the numbers in charts like the above and it’s hard to resist the pull of US subsidies.

You could take an absolutist stance and say: well, if other countries are subsidising green energy then given we know subsidies are inherently wasteful and inefficient, then the smartest thing we could do is not to compete at all, but to benefit from the cheaper prices they bring us. The UK would have access to amazing batteries from around the world. The thing is: none of them - batteries, wind turbines, solar panels, hydrogen fuel cells and electrolysers - would be made here on these shores.

As the world edges towards this new Industrial Revolution, these debates are only just beginning. In one respect the UK - unable to compete with the US, EU or China - may seem irrelevant in this race. But it is an interesting test case in how smaller countries can cope amid the blizzard of subsidies - and in what happens when one confronts mass interventionism with old fashioned laissez-faire policies. This could get… interesting.